FY21-22 Investment Overview

Our Approach

We take seriously our responsibility to serve as good stewards of donors’ charitable assets, as well as our responsibility to serve the beneficiaries of those assets.

Investment Overview

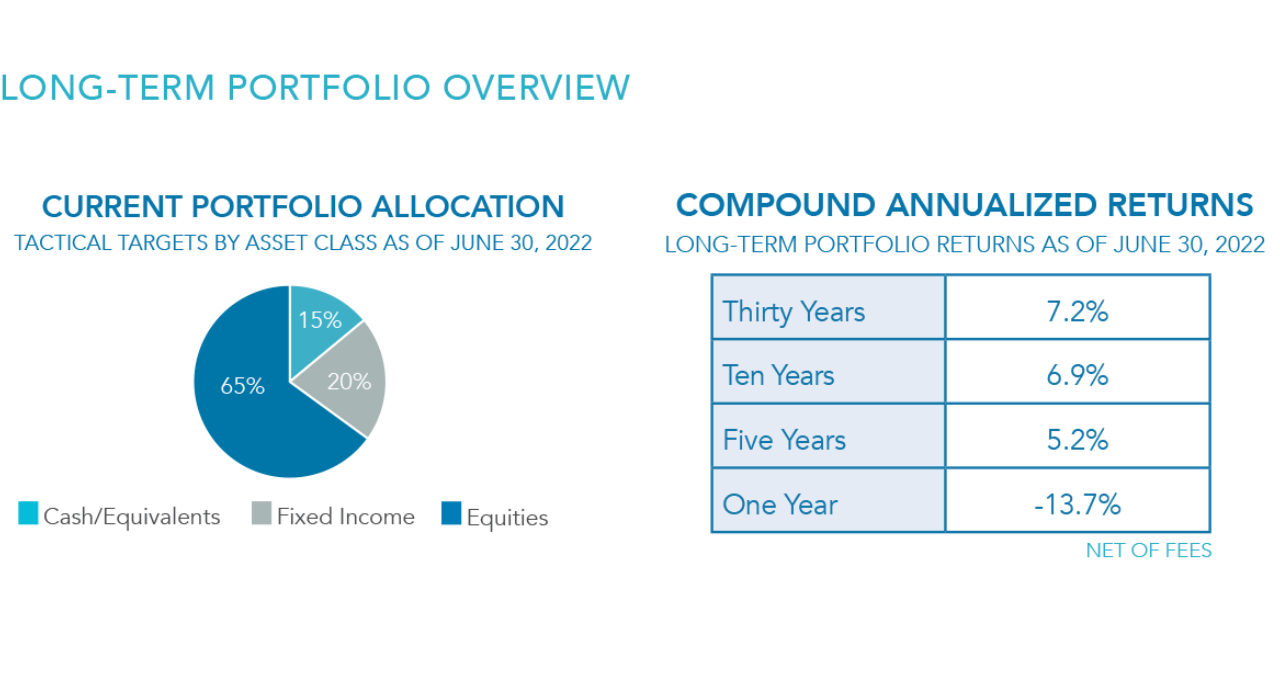

Utilizing a model created by the South Dakota Investment Council, the Foundation's Investment Management Committee helps guide the asset allocation within the Long-Term Portfolio.

Fiscal Year in Review

During fiscal year 2022, the S&P 500 closed at record highs in December and January, then began a volatile decline to hit a 52 week low in June. Even with the decline, domestic equity markets maintained a high price to earnings ratio. With the continued high equity valuations, the Foundation’s Long-Term Portfolio maintained an equity allocation of 65% all year. The Portfolio did execute a tactical shift for Large Cap equities between growth and value.

As of June 30, the Long-Term Portfolio’s equity allocation included a 30% allocation domestically to large cap stocks, evenly divided between growth and value, a 14% allocation to small and mid-cap equities and 56% allocated internationally to developed and emerging markets.

Looking ahead, the Investment Management Committee will continue to employ disciplined investment management strategies that take into account valuations, interest rates, inflation and volatility in order to make strategic investments as opportunities arise.

Our FY 2022 Investment Management Committee

We're grateful to the following individuals who volunteer their time and expertise as members of our Investment Management Committee:

- Sarah Madison, Chair

- Todd Ernst

- Susie Patrick

- Angeline Lavin

- Steve Schultz

- Scott Van Horssen